Founding of an association (2025)

This article will give you all the information you need about the process of setting up and registering a society, the documents required and the costs.

Liquidation of the Association is the process by which a society ceases to exist and is removed from the Register of Societies and Foundations. There are several reasons why a society might be wound up, from lack of funding to lack of achievement of objectives or new legislation. This blog post aims to provide a comprehensive, step-by-step guide to the dissolution of an association in Latvia.

This article is aimed at board members, members, accountants, lawyers and anyone who wants to understand the winding-up process.

New amendments to the Law on Associations and Foundations have affected the liquidation process by introducing new requirements and procedures, so it is important to keep up to date with the latest changes.

Here you will find all the information you need about the liquidation process, the documents required and the costs.

Manual to comply with changes Commercial Law, which shall enter into force on 30.12.2024, and Law on Associations and Foundations, which entered into force on 01.07.2024.

Societies can be dissolved for various reasons, including:

* Financial difficulties

* Decreasing number of participants

* Achieving objectives

* Internal conflicts between members

* Changes to legislation

* No activity or economic activity

* Mergers or acquisitions

It is important to follow legal procedures to avoid potential liabilities. For example, if the association is no longer able to cover its debts, liquidation may be the best option to avoid further financial problems. Similarly, if the association has achieved its objectives and is no longer needed, liquidation is a logical step.

The liquidator is the main person responsible for ensuring the liquidation process and his duties and responsibilities are clearly defined by law.

The liquidation process involves several institutions, such as the Register of Companies and the State Revenue Service. Each has its own role to play and requirements to meet. For example, various liquidation documents have to be filed with the Companies Register, while tax matters have to be coordinated with the State Revenue Service.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45The Society must be able to pay all its creditors! Otherwise, insolvency or bankruptcy proceedings must be initiated.

It is also important to settle all your obligations with the SRS:

This information can be easily verified In the SRS Electronic Declaration System (EDS).

For information on tax debts, see PAYMENTS.

Information on untransmitted accounts can be found under REMINDERS.

You can check information from the SRS at CORRESPONDENCE WITH VID.

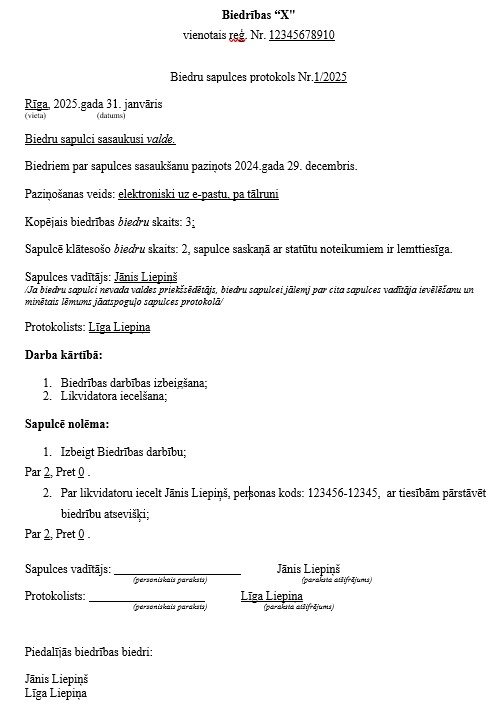

Convocation of the Members' Meeting:

* For a decision on dissolution of the association, a meeting of the members must be convened.

* A quorum must be present for the meeting to be quorate. Normally more than 50% members are required to attend a membership meeting.

* According to the new amendments to the law, remote participation and voting at the members' meeting is possible.

The convening of a general meeting is the first and very important step in the winding-up process. It is essential to ensure that all members are duly informed of the meeting and its agenda to ensure that a legitimate decision is taken.

A decision to dissolve the Society shall be adopted by the affirmative vote of more than 2/3 of the members present, unless a greater majority is required by the Statutes.

* The minutes of the members' meeting shall include the chairperson, the minutes-taker and the board member.

If the number of members is reduced to one, the decision to dissolve may be taken by the Executive Board. This is an exceptional case where the decision may be taken by the Board instead of the general meeting.

It is important to document the decision to dissolve accurately in the minutes of the members' meeting. This document will be essential for filing the winding-up documents with the Register of Companies.

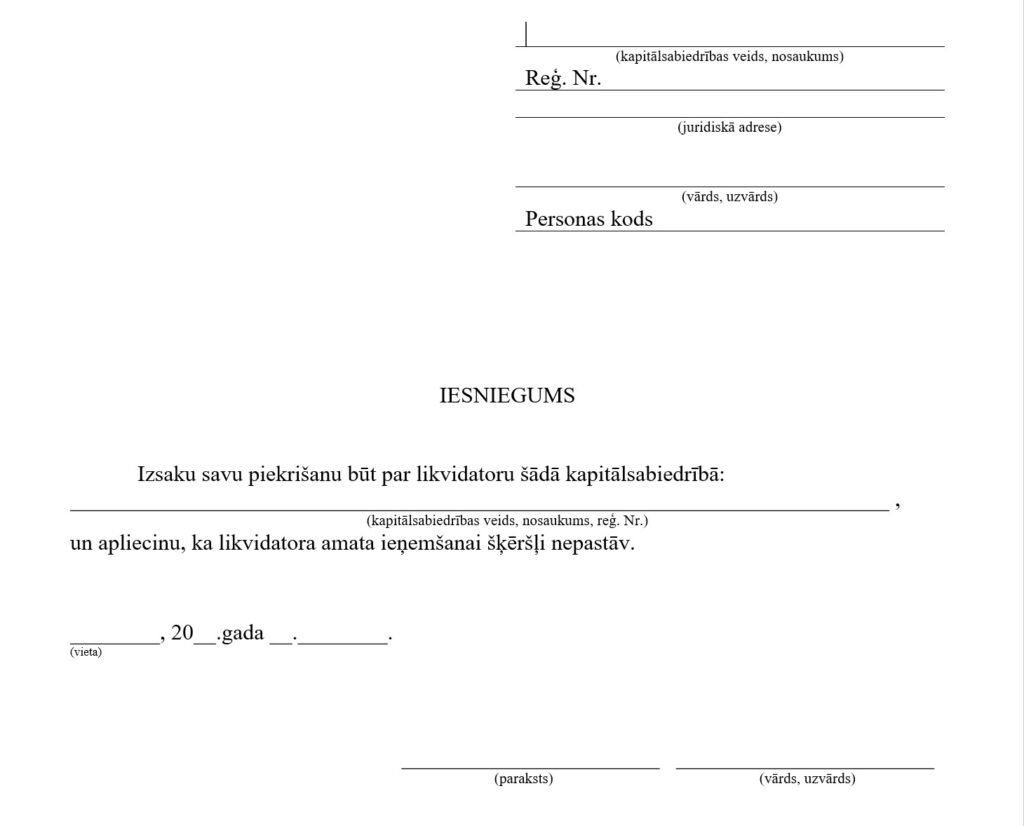

A member of the Management Board, a member of the association, another person or the liquidation committee of the association may be appointed as liquidator.

Required document:

The liquidator's consent to take up office. This confirmation may also be included in the application form B7, then a separate document may not be required.

When selecting a liquidator, it must be ensured that he is competent and capable of carrying out this responsible task.

The following documents must be submitted to the Registry Office:

Application Form B7 (Application for entry in the Register of Societies and Foundations for dissolution)

Minutes of the members' meeting or extract thereof

Board decision (if applicable)

Consent of the liquidator. This confirmation may also be included in the application form KR13, then a separate document may not be required.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45Proper preparation of liquidation forms and other documents is essential to avoid delays or refusals of liquidation at the Companies Registry. Make sure that all documents are completed accurately and in accordance with the requirements.

Paper filing with the Register of Companies is a thing of the past. Documents are no longer accepted in person.

However, if you want to file on paper, you have to pay for an expensive notary and send the documents by post.

The Application for winding-up of a company (SIA) and the accompanying documents may be submitted by the founders or an authorised person.

In the e-service.

Documents must be submitted Register of companies on the services portal.

Documents must be signed with an eSignature on a smart card (eID or eSignature card) or on the eParaksts mobile portal www.eparaksts.lv

Get your answer via an e-service or e-address.

Send electronically signed documents e-adresē or by email to the Register of Companies.

an email address is a more secure channel of communication between an individual and the state than email.

By post.

Signed documents can be sent to the Register of Companies by post.

The payment order for the stamp duty must be enclosed in the consignment. Please note that only notarised documents can be sent this way, which significantly increases the cost of registering the company.

Authentication of signature and capacity to act on applications and requests to public registers (e.g. Land Registry, Commercial Register) - €23.

In addition, there are fees for data checks, VAT, stamp duty, translation and actual costs.

The amount of the stamp duty is EUR 5.69.

* Exempt from the state fee are associations of disabled persons, orphans or large families; associations the purpose (or one of the purposes) of which is the organisation of sports events for children and schoolchildren.

Payment of the fee is made via the Register of Entrepreneurs' platform or the documents must be accompanied by a payment order for payment of the fee.

Dissolution of the Society Preparation of documents for registration with the Register of Companies usually costs between EUR 49 and EUR 120, depending on the price of the service provider and the number of documents to be prepared.

7 days (excluding the day of submission)

The statutory time limit for the examination of documents may be extended on the basis of Section 64(2) of the Administrative Procedure Law.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45In the cases provided for by law, the application for registration of changes may be sent to the State Revenue Service for examination.

After a positive decision by the UR, creditors must be notified of the opening of liquidation.

The liquidator shall, within 15 days after the adoption of the decision, publish a notice on the liquidation of the association in the official publication "Latvijas Vēstnesis".

The notice must invite creditors to submit their claims within 6 months.

Publication of the notice "Latvijas Vēstnesī" is a mandatory step to inform creditors of the winding-up of the association. This step is important to ensure that all creditors are informed and can lodge their claims within the time limit.

In order for the Register of Enterprises to exclude a Society from the Register of Societies and Foundations, it must first be ensured that the company has no debts to the State Revenue Service (SRS).

It is advisable to settle all tax matters before submitting the documents for liquidation. The Registrar of Companies will check this for you by requesting a certificate from the SRS. If the SRS replies that the association has outstanding liabilities, the Registrar of Companies will not be able to complete the liquidation of the association.

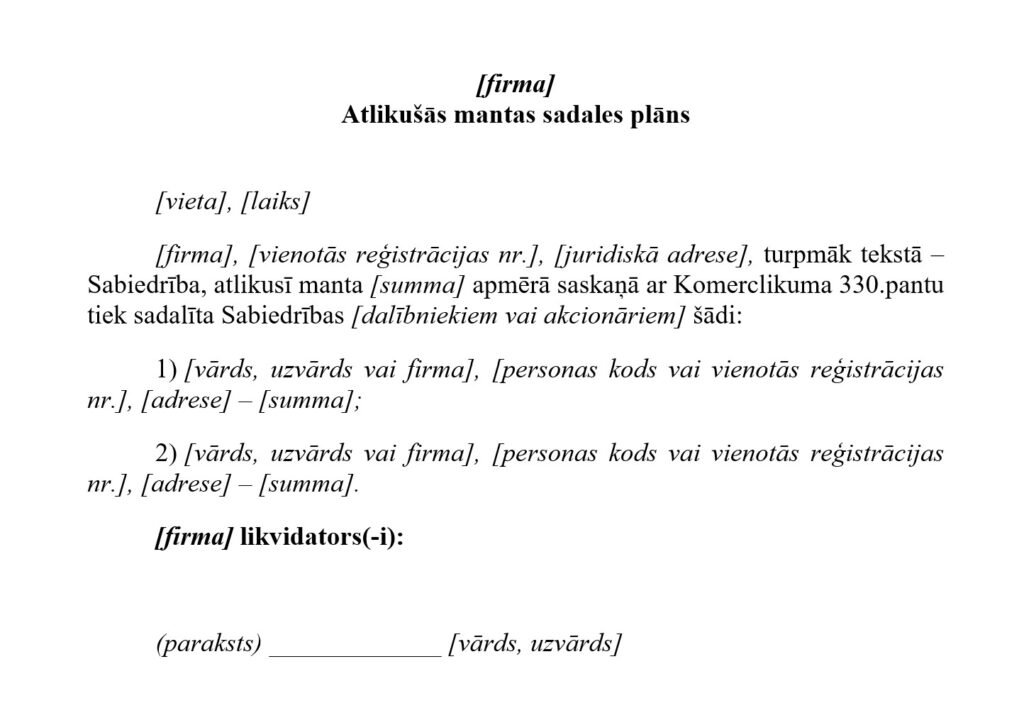

Dissolution of the Society In Stage 2, the remaining assets, including money, property and other assets, shall be distributed among its members. This distribution shall be made in accordance with a plan drawn up by the liquidator.

Payments to members are usually made in cash. However, if members wish to receive their share of the assets and the statutes of the association do not provide for this, they have the option of amending the statutes to allow the distribution of assets. Such a decision must be taken at a members' meeting before the association is removed from the Register of Associations and Foundations. At the same time as the statutes are amended, the members may agree on a specific distribution of property to each member.

It is important to remember that once a society has been removed from the Register of Societies and Bod foundations, no changes can be made. If there is still property registered in the name of the society or money in a bank account after this point, members will no longer be able to take possession of it. It is therefore essential to resolve all property distribution issues in good time before the winding-up process is completed.

1. Close your company bank account

2. Remove departments, cash registers, POS terminals from the inventory

3. Release all staff

4. Terminate your contractual obligations (Tele2, Lmt, etc.). If necessary, transfer the phone number to a natural person

5. Hand in all reports.

6. Give the documents to an archive or store them yourself.

7. Notify the SRS of the liquidation. List >> Notify the SRS

A liquidation financial statement must be prepared and submitted to the SRS EDS system.

Please note that the winding-up financial statements may only be submitted after the deadline for creditors' applications (6 months) specified in the winding-up application form.

The deadline for creditors' applications shall begin on the date on which the notice of liquidation was published in Latvijas Vestnesis.

The exact date of the announcement can be found in Latvijas Vesnesis - Search official publication.

Before the property can be distributed to the members, creditors' claims must be satisfied.

The remaining assets must be distributed in accordance with the statutes. The property may be distributed not earlier than six months after the publication of the notice in the Official Gazette.

The proper satisfaction of creditors' claims and the preparation of the closing financial statements are essential to ensure that the winding-up process complies with the law. The distribution of assets must be made in accordance with the statutes and only after creditors' claims have been satisfied.

The following must be submitted to the UR dissolution of the association documents:

Application form B9

Closing financial statement

Plan for the distribution of the remaining assets (if applicable)

Auditor's report (if applicable)

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45The amount of the stamp duty is EUR 5.69.

* Exempt from the state fee are associations of disabled persons, orphans or large families; associations the purpose (or one of the purposes) of which is the organisation of sports events for children and schoolchildren.

Payment of the fee is made via the Register of Entrepreneurs' platform or the documents must be accompanied by a payment order for payment of the fee.

7 days (excluding the day of submission)

Before applying for winding-up, make sure that all your obligations to the NHS have been settled. The liquidation will only be finalised in the register of companies after the UR has received the confirmation from the SRS.

Tax arrears can have a significant impact on the liquidation process. It is important to address tax issues early and possibly agree with the SRS on a payment schedule or sale of assets to settle debts.

If the association has no assets to distribute, the process may be simpler, but it is still important to comply with all legal requirements.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45Liquidation of the Association is a complex process that requires careful compliance with laws and regulations. This guide provides a step-by-step explanation of the winding-up process to help associations complete it successfully. If you have any questions or uncertainties, always consult a lawyer. A successful liquidation ensures that the association is wound up in accordance with the law and without negative consequences.

Errors often arise from misrepresentation of the association's details in various documents or from inaccurate details of the board of directors.

One of the most common mistakes is when the decision to wind up is taken by a board whose term of office has expired. In such a case, the Board is not empowered to take decisions. Problems also arise if the members' meeting deciding on dissolution does not appoint a liquidator.

The application for registration of the winding-up shall designate as liquidator a person whose appointment has not been decided by the members' meeting.

The notice of liquidation has not been published in the official gazette "Latvijas Vēstnesis" or has been published without observing the 15-day deadline after the adoption of the decision.

Before filing for winding-up, it is important to make sure that all obligations with the State Revenue Service (SRS) have been settled. The UR requests a certificate from the SRS electronically and, if information about outstanding liabilities is received, the liquidation is postponed.

An application for the exclusion of a society from the Register shall be submitted earlier than 6 months after the publication in the "Latvijas Journal".

Make sure the documents are in the correct format.

Documents must be signed with a secure electronic signature and time stamp.

Before submitting the documents, you must make sure that the amount of the stamp duty is correct and that you have paid it. Any incorrect or overpaid amount can be recovered by applying to the Companies Registry.

If the UR finds an error, the notary public postpones the decision for up to 30 days, pointing out the deficiencies. It is important to react promptly to such decisions and make the necessary corrections so that the registration process is not delayed and stamp duty is not lost.

The minutes of a members' meeting are not drawn up in accordance with the requirements, the chairman of the meeting, the minutes-taker or the accuracy of the minutes is not certified by a member of the Board.

The remaining assets of the Society shall be distributed after all creditors' claims have been satisfied.

An advertisement must be submitted to the Latvian Gazette after the first stage of the winding-up of the association.

The required quorum is not met (usually more than 50% members) or the required majority (usually 2/3 of those present) has not voted in favour of dissolution. It is important to document the decision accurately.

The main reason is almost always to do with the State Revenue Service (SRS). The UR requests the SRS electronically for a certificate of fulfilment of obligations before expelling the association. Liquidation will be postponed if:

The association has tax arrears.

Not all required reports or annual accounts have been submitted to the SRS.

The UR will not be able to complete the liquidation until it has received confirmation from the SRS that all liabilities have been settled.

These are compulsory payments without which the liquidation process cannot be carried out. If there are no funds in the Society's treasury, they must be covered from other sources, such as members' donations. It should be noted that associations of disabled persons, orphans or large families, as well as those whose aim is to organise sports events for children and schoolchildren, are exempt from stamp duty.

No, face-to-face acceptance is a thing of the past. The main way of submitting documents is electronically via the UR e-services portal, by signing documents with a secure electronic signature. You can send documents by post, but they have to be notarised, which makes the process much more expensive.

Publication of the notice is a compulsory step to be taken by the liquidator within 15 days of the decision to wind up. Without this publication, the deadline for creditors' applications does not start and you cannot lawfully proceed to the second stage of the winding-up - the submission of the closing balance sheet and the application for striking off the association from the register.

No. If the association is unable to pay all its creditors, insolvency proceedings must be opened instead of liquidation. The distribution of assets among the members may only take place after all creditors' claims have been satisfied.

The winding-up process usually takes at least 7-8 months. The process involves two main stages. In the first stage, the Registrar of Companies adopts a decision on the dissolution of the association, which usually takes 7 days (excluding the day of filing). The second stage starts after the deadline for creditors to apply, which is at least 6 months after the publication of the notice in the Official Gazette. The application for winding-up is then examined by the OF, which can take up to 17 days. The deadline may be extended if the UR requests additional information or finds deficiencies.

Even if the association has no assets and no activities, it must be wound up in accordance with the law. The process is similar but can be simpler as there are no assets to divide. If the association is inactive, for example, it cannot be reached at its registered office or the board has no representation for a long period of time, the Registrar of Companies may decide to dissolve the association. However, a liquidator must be appointed and other prescribed steps must be taken to complete the winding-up.

A member of the Management Board, a member of the Society or any other natural person having the capacity to act may be appointed as liquidator. If there are several liquidators, they usually represent the association jointly. The liquidator is responsible for the orderly conduct of the winding-up, including the identification of creditors, the satisfaction of claims, the preparation of the final accounts and the distribution of the residual assets. The liquidator shall be liable for any damage caused by his own fault and, if there are several liquidators, jointly and severally liable.

Yes, the legislation allows for remote meetings and decision-making. Documents can also be submitted to the Register of Enterprises electronically using the e-services portal and signed with a secure electronic signature. This is the preferred and most convenient way of submitting documents.

As long as the association has not been excluded from the Register of Associations and Foundations, the members' meeting may decide to revoke the liquidation and continue the activities. Such a decision must be notified to the Register of Enterprises.

If the term of office of the Governing Board has expired, it may no longer decide to dissolve the Society. In such a case, the members' meeting must elect a new board or immediately appoint a liquidator to manage the liquidation process. If this is not done, the Registrar of Companies may initiate the compulsory dissolution of the association.

Website of the Register of Companies (UR): [https://www.ur.gov.lv/]

State Revenue Service (SRS) website: [https://www.vid.gov.lv/]

Law on Associations and Foundations: [https://likumi.lv/]

Latvijas Vēstnesis: [https://www.vestnesis.lv/]

This article will give you all the information you need about the process of setting up and registering a society, the documents required and the costs.

Company Liquidation (SIA) 2025: Step-by-Step Guide Liquidating a company, especially a SIA in Latvia, can seem complicated and even stressful