Founding of an association (2025)

This article will give you all the information you need about the process of setting up and registering a society, the documents required and the costs.

Winding up a company, especially a liquidation of an LLC in Latvia, can seem like a complicated and even stressful process. However, with a proper understanding of the procedures and by following specific steps, it can be done efficiently and without unnecessary problems.

In this article, we present a clear step-by-step guide to the liquidation of an LLC, helping entrepreneurs, accountants and other stakeholders to navigate the process.

Here you will find all the information you need about the liquidation process, the documents required and the costs.

Manual to comply with changes Commercial Law, which enters into force on 16.07.2025.

The liquidation of a company in Latvia is primarily governed by the Commercial Code. In addition, it is important to take into account other laws, regulations and institutions, such as the Register of Companies (UR) and the State Revenue Service (SRS). The liquidator is the main person responsible for ensuring the liquidation process and his duties and responsibilities are clearly defined by law.

It is important to keep abreast of changes in legislation to ensure compliance with current requirements.

The liquidation process involves several institutions, such as the Register of Companies and the State Revenue Service. Each has its own role to play and requirements to meet. For example, various liquidation documents have to be filed with the Companies Register, while tax matters have to be coordinated with the State Revenue Service.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45The company (SIA) must be able to pay all its creditors! Otherwise, insolvency or bankruptcy proceedings must be opened.

It is also important to settle all your obligations with the SRS:

This information can be easily verified In the SRS Electronic Declaration System (EDS).

For information on taxes, see PAYMENTS and information on reviews in REMINDERS.

You can check information from the SRS at CORRESPONDENCE WITH VID.

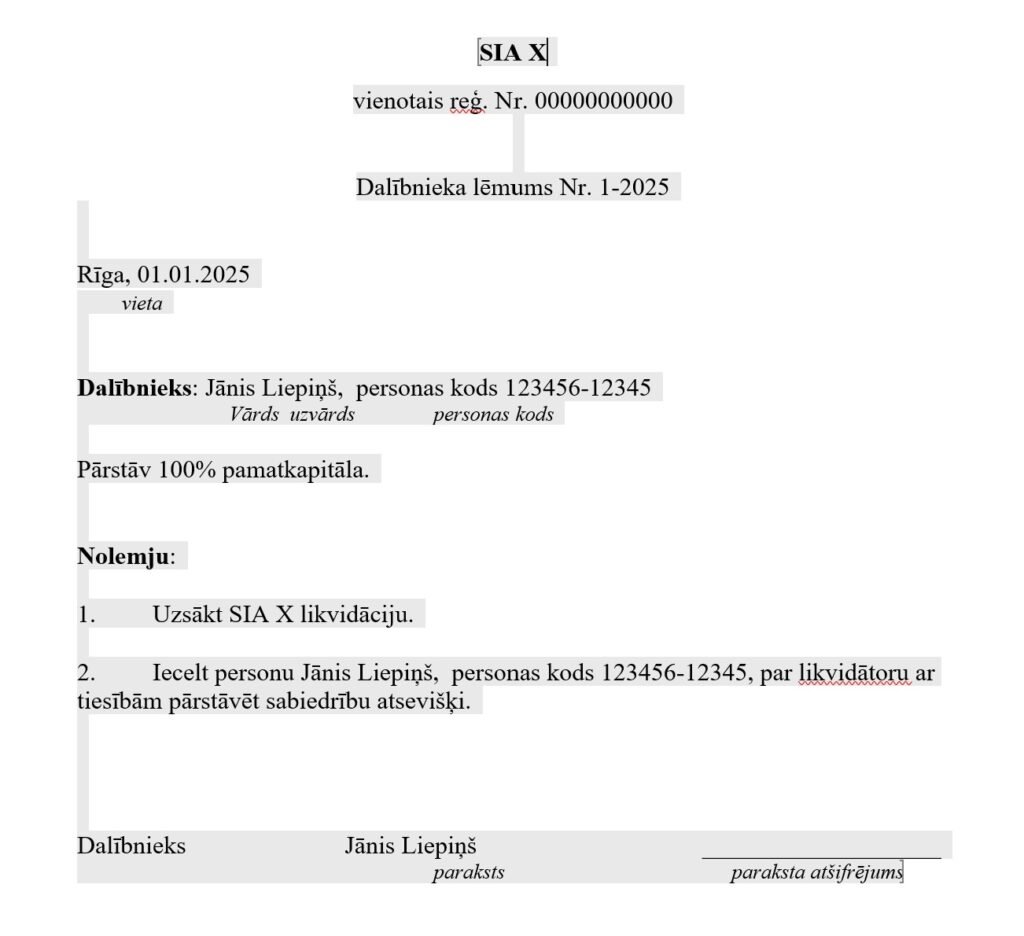

The decision to wind up the company must be taken at a meeting of the members.

Required document: Minutes or decision of the meeting of members. Remember that you can participate in meetings remotely.

This decision is the basis for future actions, so it is important to get it right.

A member of the Management Board or another person may be appointed liquidator.

Required document:

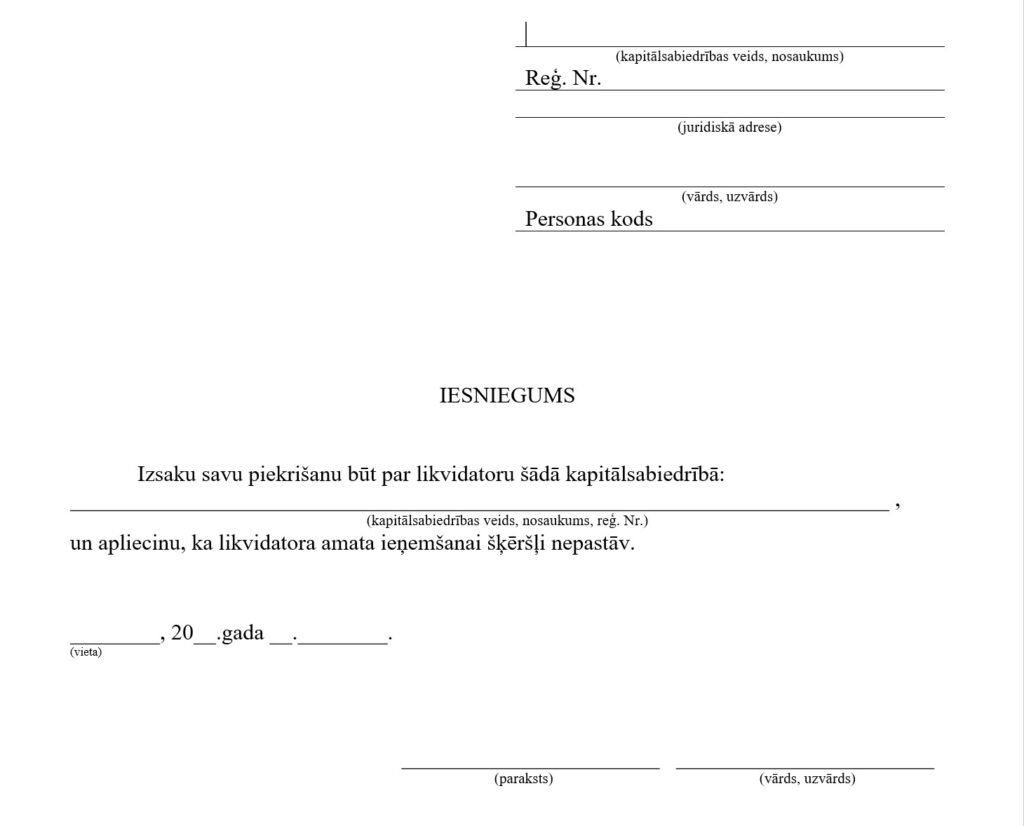

The liquidator's consent to take up office. This confirmation may also be included in the application form KR13, then a separate document may not be required.

When selecting a liquidator, it must be ensured that he is competent and capable of carrying out this responsible task.

The following documents must be submitted to the UR for the liquidation of the Company (SIA):

Form KR13

Minutes or decision of the meeting of members

Consent of the liquidator. This confirmation may also be included in the application form KR13, then a separate document may not be required.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45Paper filing with the Register of Companies is a thing of the past. Documents are no longer accepted in person.

However, if you want to file on paper, you have to pay for an expensive notary and send the documents by post.

The Application for winding-up of a company (SIA) and the accompanying documents may be submitted by the founders or an authorised person.

In the e-service.

Documents must be submitted Register of companies on the services portal.

Documents must be signed with an eSignature on a smart card (eID or eSignature card) or on the eParaksts mobile portal www.eparaksts.lv

Get your answer via an e-service or e-address.

Send electronically signed documents e-adresē or by email to the Register of Companies.

an email address is a more secure channel of communication between an individual and the state than email.

By post.

Signed documents can be sent to the Register of Companies by post.

The payment order for the stamp duty must be enclosed in the consignment. Please note that only notarised documents can be sent this way, which significantly increases the cost of registering the company.

Authentication of signature and capacity to act on applications and requests to public registers (e.g. Land Registry, Commercial Register) - €23.

In addition, there are fees for data checks, VAT, stamp duty, translation and actual costs.

State fee for liquidation of the Company (LLC) - 30EUR. The fee is payable on the platform of the Register of Enterprises or the documents must be accompanied by a payment order for payment of the fee.

The cost of preparing the liquidation documents for registration in the Register of Enterprises usually ranges from EUR 49 to EUR 120, depending on the price of the service provider and the number of documents to be prepared.

1-3 working days (excluding day of submission)

The statutory time limit for the examination of documents may be extended on the basis of Section 64(2) of the Administrative Procedure Law.

In the cases provided for by law, the application for registration of changes may be sent to the State Revenue Service for examination.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45After a positive decision by the UR, creditors must be notified of the opening of liquidation.

The notice is published automatically by the Register of Companies and is free of charge.

Creditors must be given a deadline to submit their claims (1-3 months). The deadline for creditors to submit their claims is at least one month.

In order for the Register of Companies to remove a company from the register, it must first make sure that the company has no debts to the State Revenue Service (SRS).

It is advisable to settle all tax matters before submitting the documents for liquidation. The Registrar of Companies will check this for you by requesting a certificate from the SRS. If the SRS replies that the company has outstanding liabilities, the Registrar of Companies will not be able to complete the liquidation of the company.

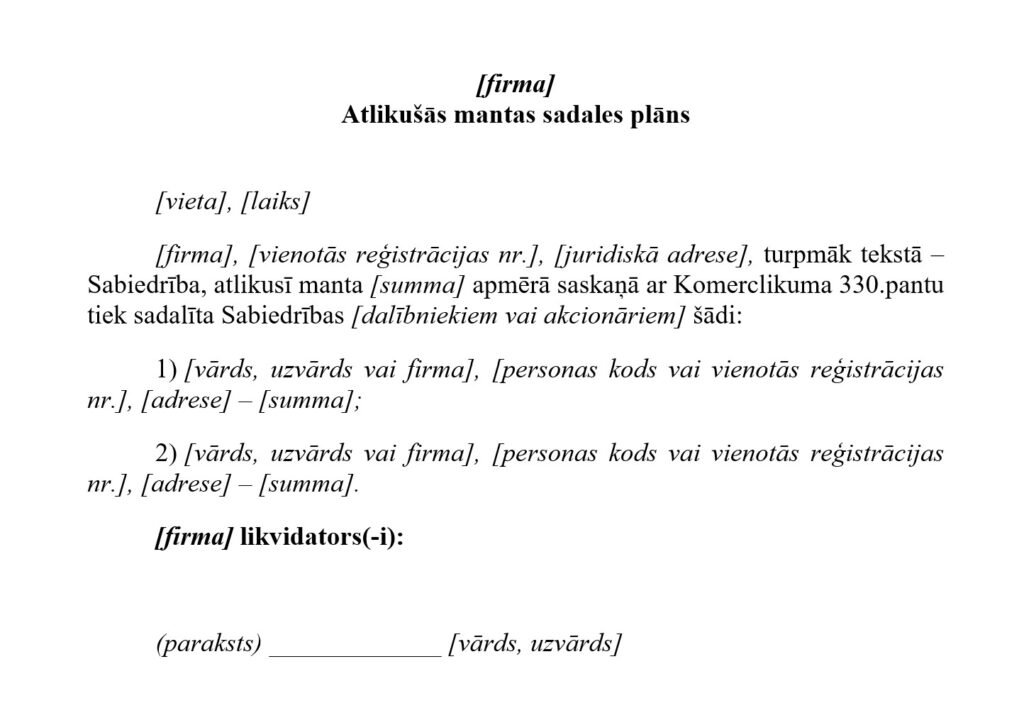

In Stage 2 of the winding-up, the remaining assets, including cash, property and other assets, are distributed among the members. This distribution shall be made in accordance with a plan drawn up by the liquidator, taking into account the amount of each member's contribution, unless the company's instruments of incorporation provide for a different principle of distribution.

Payments to participants are usually made in cash. However, if members wish to receive their share of the assets, and the company's articles do not provide for this, they have the option of amending the articles to authorise a distribution of the assets. Such a decision must be taken at a meeting of the members before the company is removed from the Commercial Register. At the same time as the articles of association are amended, the members may agree on a specific distribution of assets to each member.

It is important to remember that once a company has been removed from the Commercial Register, no changes can be made. If there is still property registered in the name of the company or money in a bank account after this point, the members will no longer be able to take possession of it. It is therefore essential to resolve all distribution issues in good time before the winding-up process is completed.

1. Close your company bank account

2. Remove departments, cash registers, POS terminals from the inventory

3. Release all staff

4. Terminate your contractual obligations (Tele2, Lmt, etc.). If necessary, transfer the phone number to a natural person

5. Hand in all reports.

6. Give the documents to an archive or store them yourself.

7. Notify the SRS of the liquidation. List >> Notify the SRS

A liquidation financial statement must be prepared and submitted to the SRS EDS system.

Please note that the liquidation financial statements may only be submitted after the deadline for creditors' applications (1-3 months) specified in the liquidation application form.

The time limit for the application of creditors starts on the date on which the notice of winding-up is published in the Register of Companies.

The exact date of the notification can be found in the Companies Register - Notices to creditors, members, interested parties.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45The following documents must be submitted to the UR for the liquidation of the Company (SIA):

Form KR14

Final financial statement of the winding-up.

Plan for the distribution of the remaining assets (if applicable)

Auditor's report (if applicable)

No stamp duty! The completion of the winding-up of a company (limited liability company) is free of charge.

1-3 working days (excluding day of submission)

The company is deleted from the Commercial Register on the date on which a positive decision on the liquidation of the company was taken.

Tax arrears can have a significant impact on the liquidation process. It is important to address tax issues early and possibly agree with the SRS on a payment schedule or sale of assets to settle debts.

If a company is unable to pay its debts, insolvency proceedings may be opened, which are different from liquidation.

If the company has no assets to divide, the process may be simpler, but it is still important to comply with all legal requirements.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €45Winding up a company (LLC) is a complex process that requires careful attention to detail and compliance with legal requirements. To avoid mistakes and ensure a successful liquidation, it may be necessary to turn to professionals. Remember that proper planning and adequate documentation are key factors in making the process as simple and efficient as possible.

Errors often arise from misrepresentation of data in various documents or from inaccurate board data.

Any error in the application forms (KR13 or KR14), the decision of the participants or the minutes - wrong date, incorrect name, forgotten point - will result in the application being postponed.

The application for registration of the winding-up shall designate as liquidator a person whose appointment has not been decided.

Before filing for winding-up, it is important to make sure that all obligations with the State Revenue Service (SRS) have been settled. The UR requests a certificate from the SRS electronically and, if information about outstanding liabilities is received, the liquidation is postponed.

Make sure the documents are in the correct format.

Documents must be signed with a secure electronic signature and time stamp.

Before submitting the documents, you must make sure that the amount of the stamp duty is correct and that you have paid it. Any incorrect or overpaid amount can be recovered by applying to the Companies Registry.

If the UR finds an error, the notary public postpones the decision for up to 30 days, pointing out the deficiencies. It is important to react promptly to such decisions and make the necessary corrections so that the registration process is not delayed and stamp duty is not lost.

The second stage documents (form KR14) may only be submitted after the creditor application period has expired (minimum one month). This period starts from the date of publication of the notice by the UR, not from the date of the decision of the members.

Once the company is removed from the register, it becomes virtually impossible to access its accounts or manage its assets. It is therefore critical to close all bank accounts and re-register property Before submission of second-stage documents

The liquidation process is reserved for companies that are able to cover all their liabilities. If debts exceed assets, insolvency proceedings must be opened. Ignoring these facts can have serious legal consequences for the liquidator and the board.

If the company is left with assets (including cash) after all creditors' claims have been met, a distribution plan must be prepared and submitted.

Before removal from the register, the liquidator must certify that the company's documents have been deposited in the archives. Ignoring this issue can lead to future liability.

Most often, the Registry Office delays or refuses registration of a winding-up if incomplete or incorrect documents have been submitted. The most popular errors are:

Incorrect application forms (KR13 or KR14).

The minutes or the decision lack essential information, such as the appointment of a liquidator or the deadline for creditors to apply.

No liquidator's consent (if required).

Documents do not have the appropriate legal value (e.g. not signed with a secure electronic signature or not notarised, if required).

No stamp duty has been paid or no proof of payment has been provided.

The process can also be delayed if the UR sends the application to the State Revenue Service (SRS) for verification.

The first stage of liquidation (the start of liquidation) will also be registered by the UR with existing tax debts. However, the second and final phase of the liquidation cannot be completed until all obligations with the SRS have been settled. Before submitting the second stage documents, the UR requests a certificate from the SRS on the fulfilment of obligations. If the SRS replies that the company is in arrears, the UR will not be able to exclude the company from the commercial register.

No, face-to-face acceptance is a thing of the past. The main way of submitting documents is electronically via the UR e-services portal, by signing documents with a secure electronic signature. You can send documents by post, but they have to be notarised, which makes the process much more expensive.

If the company has no known creditors, the process can take just over a month. If there are creditors, the process will take longer - at least three months - because the legal minimum period for creditors to lodge claims is one month, but in practice it is often three months.[7][8] The decision on each of the steps is usually taken by the UR within 1-3 working days of receipt of the documents. However, the overall time may be affected by the speed of the paperwork, the bookkeeping and a possible audit by the SRS, which can extend the process by up to several months.

A member of the Management Board, a member or any other natural person having the capacity to act may be appointed liquidator. If an existing board member is appointed liquidator, the process is simpler - no separate consent of the liquidator is required and no signatures on the resolution of the members' meeting need to be witnessed. If a person other than a member of the Management Board is appointed, that person's written consent to the appointment is required.

If a limited liability company is unable to pay its debts to its creditors, including the SRS, voluntary liquidation is not possible. In such a case, the liquidator is obliged to file for insolvency proceedings. Trying to liquidate a company by ignoring debts will result in the company not being removed from the register.

Submitting documents in person on paper is no longer possible. Documents can be submitted:

Electronically: Through the UR services portal, signed with a secure electronic signature (eID card or eParaksts mobile).

By post: In this case, all signatures on the documents have to be notarised, which makes the process significantly more expensive.

The liquidator is responsible for identifying all creditors and assets. If new creditors are discovered after the opening of the liquidation, their claims must be included in the list of liabilities and settled in the ordinary way. If previously unknown assets are discovered, they must be sold to raise funds to meet creditors' claims. All these processes should be reflected in the winding-up financial statements.

Yes, as long as the company has not been removed from the commercial register, the members can decide to wind up the liquidation and reopen the company. This decision must be notified to the Registrar of Companies by way of an application.

The most common reason is a negative certificate from the SRS for outstanding debts. Another reason may be errors in the winding-up financial statements or the distribution plan. It is important to submit documents only after the deadline for creditors to apply has passed and all liabilities have been settled.

If the company has no assets, the process is simpler as there is no need to draw up a distribution plan. However, the other steps, including the adoption of the decision, the appointment of the liquidator, the notification to the UR and the SRS, and the preparation of the winding-up financial statements ("zero" statements), are mandatory. The main condition is that there must be no debts.

Website of the Register of Companies (UR): [https://www.ur.gov.lv/]

State Revenue Service (SRS) website: [https://www.vid.gov.lv/]

Law on Associations and Foundations: [https://likumi.lv/]

Latvijas Vēstnesis: [https://www.vestnesis.lv/]

This article will give you all the information you need about the process of setting up and registering a society, the documents required and the costs.

Share capital of an LLC: learn about the different contribution options, the differences between a small-cap and a full-cap LLC, and the advantages and disadvantages.