Founding of an association (2025)

This article will give you all the information you need about the process of setting up and registering a society, the documents required and the costs.

Company Forming a limited liability company - This is a simplified guide to setting up and registering a limited liability company with the Register of Companies, from choosing the right business structure to meeting the legal requirements.

Here you will find all the information you need about the process of setting up and registering a limited liability company, the documents required for setting up a company and the costs of registration.

Manual to comply with changes Commercial Law, which enters into force on 16.07.2025.

A limited liability company is a limited liability company whose share capital consists of contributions from its members and whose shares are not publicly available.

A limited liability company is a legal person and is deemed to be established and acquires the status of a legal person on the date on which it is registered Register of companies in the commercial register.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €25

Setting up an LLC starts with choosing a business. When setting up a new company, you need to choose the amount of initial share capital. If the share capital is planned to be up to EUR 2800, for example EUR 1, then Small capital SIA.

In this guide, we will talk about setting up and registering a limited liability company with full share capital of at least €2800.

There are several options for the establishment and registration of a full capital company with a share capital of at least EUR 2800 benefits.

Extraordinary dividends. According to For the Commercial Code for a limited liability company, dividends are determined and paid in accordance with a resolution of the members' meeting. The members of the company may decide on the payment of dividends every 3 months after the payment of the previous dividend. It should be noted that the LLC must not have tax debts and the Company may pay out in extraordinary dividends not more than 85 per cent of the profits made in the period for which the extraordinary dividend is determined.

The payment of extraordinary dividends could be a major relief for service providers or micro-businesses, where under certain conditions no salary can be paid.

The corporation tax (CIT) on dividend payments is 20%.

In the law "On state social insurance" Company for members of the Management Board do not have to sign an employment contract and pay yourself a salary if the following conditions are met:

If the sole member of the limited liability company and the member of the board of directors himself provides a service and produces or sells goods in small quantities, he can pay himself dividends once a year or extraordinary dividends every 3 months.

Small capital SIA extraordinary dividends are prohibited.

The process of setting up a company involves a number of steps, including registering with the Commercial Register of Companies and opening a fintech company or bank account.

Below you will find the necessary sequence of the company formation process.

Prepare the Company Incorporation Documents needed to register your LLC In the Register of Companies.

Temporary account is a mandatory requirement before registering an LLC In the Register of Companies.

When you open a temporary account, you will need the incorporation documents, the memorandum or articles of association of your limited liability company. This means you will need to have documents for registering a limited liability company.

The share capital is payable in full by the time of application.

The cash contribution must be paid into a suspense account.

For more information on the possibilities to contribute share capital - Share capital in an LLC: Tips and Options.

Start the LLC registration service In the Register of Companies.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €25Don't forget to electronically sign the documents you need to submit to set up your LLC.

Submitted to of the company The notary examines the documents for the establishment of an LLC within 1 to 3 working days.

Below you will find the documents you need to set up an LLC.

Sample documents can be found at On the website of the Register of Companies.

Completing and submitting documents accurately requires specific knowledge and expertise.

Documents must be completed in Latvian.

Deadline for submitting documents to the Register of Companies: not set.

Check that the chosen company name is not already in use and that it complies with legal regulations.

Finding the perfect name for your business might not be so difficult. It doesn't have to match the names of your products, services or brands. However, there are some limitations to consider:

When planning your business development and digital presence, it is worth looking into whether domain names such as .lv or .eu are freely available. You can check for Latvian (.lv) domain names NIC on the home page, and European and Worldwide domain names InstantDomainSearch on the domain search platform.

You cannot set up and register a limited liability company without a registered office.

Every company is obliged to register an address where the board of directors can be reached.

When registering a limited liability company with a share capital of 2800 EUR or more, the share capital can be paid as follows:

The URonline team will prepare and submit all the necessary documents on your behalf

Only €25

A member of a limited liability company is a person entered in the register of members who owns one or more shares in the company.

A share entitles a member to participate in the management of the company, the distribution of profits and the distribution of the assets of the LLC in the event of the company's liquidation.

The executive body of the Company is the Board of Directors, which manages and represents the Company Ltd.

The Board may be composed of one or more members. In a small-capital limited liability company, all the members of the board are members of the company. A chairman may be elected from among the members of the board to organise the work of the board.

Members of the Board are appointed for an indefinite term, unless the statutes provide for a specific term of office.

All members of the Management Board shall have the rights of representation set out in the Statutes. The members of the Management Board may be granted individual or joint representation rights. In determining the rights of representation, the principle that each member of the Management Board shall have effective rights of representation shall be respected. For example, if there are two members of the board, it is not possible to give one a separate right of representation and the other a joint right of representation, since in that case the right of representation of the other member would be formal and not real.

A member of the Supervisory Board of that company, an auditor of that company and a member of the Supervisory Board of the parent company of the Group may not be a member of the Management Board.

The Supervisory Board is the supervisory body that oversees the Board's activities. The Supervisory Board of an LLC is optional.

If a Board is established, it may be composed of between 3 and 20 members, as defined in the Statutes. A chairperson and a vice-chairperson may be appointed from among the members of the Board.

The Council shall be elected by the Members for an indefinite period, unless otherwise provided in the Statutes.

The Board may not include persons who are members of the board of directors, auditors, proxies or commercial agents of that company, or members of the board of directors of a dependent company of that company, or a person entitled to represent that dependent company.

Only a person who is not prohibited from holding such a position and who is not included in the SRS list of persons at risk may be appointed as a member of the Management Board or Supervisory Board.

Temporary account is a mandatory requirement, except where the share capital is paid up solely by means of a contribution in kind valued by a certified valuer of the Companies Register.

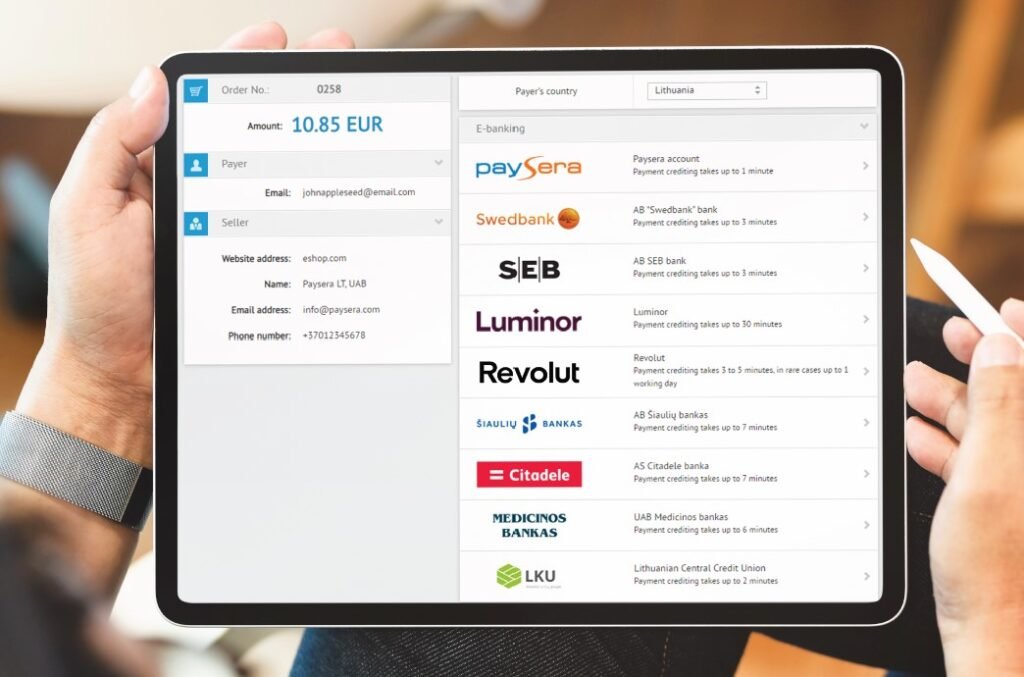

You can open a temporary account with a bank, for example Citadel, SEB, Swedbankor a fintech company like Paysera or Revolut.

It's much more convenient to do it remotely. Fintech companies offer.

Please note that when opening a temporary account, you will need the LLC's incorporation documents, a memorandum of association or an agreement. This means that you will need to have For the registration documents of a limited liability company.

The share capital is payable in full by the time of application. The cash contribution must be paid into a suspense account.

The member or members pay the amount of the share capital into a suspense account. If there are several members, each member must pay in his or her share of the share capital.

The Register of Enterprises shall not require documents evidencing the contribution of share capital if the share capital or part thereof is paid up in cash and the cash contribution does not exceed EUR 50 000. The founders will certify in their application to the Registry that a payment account has been opened in the name of the company to be incorporated and that the payment of the share capital has been made therein. The current KR4 form must be used.

The cost of preparing the documents for registering an LLC with the Register of Entrepreneurs usually ranges from EUR 25 to EUR 120, depending on the price of the service provider and the number of documents to be prepared.

What's included in URonline In the LLC registration service?

Paper filing with the Register of Companies is a thing of the past. Documents are no longer accepted in person.

However, if you want to file on paper, you have to pay for an expensive notary and send the documents by post.

URonline specialises in modern technologies and will help you to make Registering a Company Ltd 100% Onlinewhich is an efficient, time- and money-saving solution.

Our EXPERT e-filing service relieve you of the effort or specific knowledge to successfully file the documents and administer the process of registering your LLC.

The Application for the establishment of a limited liability company and the accompanying documents may be submitted by the founders or by an authorised person.

In the e-service.

Documents must be submitted Register of companies on the services portal.

Documents must be signed with an eSignature on a smart card (eID or eSignature card) or on the eParaksts mobile portal www.eparaksts.lv

Get your answer via an e-service or e-address.

Send electronically signed documents e-adresē or by email to the Register of Companies.

an email address is a more secure channel of communication between an individual and the state than email.

By post.

Signed documents can be sent to the Register of Companies by post.

The payment order for the stamp duty must be enclosed in the consignment. Please note that only notarised documents can be sent this way, which significantly increases the cost of registering the company.

Authentication of signature and capacity to act on applications and requests to public registers (e.g. Land Registry, Commercial Register) - €23.

In addition, there are fees for data checks, VAT, stamp duty, translation and actual costs.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €25Congratulations! Your company is registered in the Commercial Register and has been assigned a registration number.

The decision issued by the Register of Companies on the registration of the company will serve as the basis for the re-registration of the Temporary Account as a permanent current account.

It's a relatively simple and easy step. Fintech companies can do it remotely, but banks may require you to come in person.

You must register the type or types of business activity of the LLC with the State Revenue Service within one month from the date of registration. The type of activity must be registered with the SRS EDS electronic declaration system The type of activity must comply with NACE for classification

Check whether the type of business activity planned requires licence or permit. You may need to obtain the appropriate licence or permit before you can actually start your business.

If you intend to supply services and sell goods in Latvia and the EU, and your income does not exceed €50,000 per year, you do not need to register for VAT.

If you register for VAT, you will have to pay 21% VAT on your services or goods.

Compulsory registration requirements in the VAT register:

To register for VAT, you must submit an application to the SRS EDS in the system or with the Register of Companies at the same time as the application for registration of the LLC.

The State Revenue Service shall examine the application within 14 days.

Accounting law provides that the accounts may be kept by the director of the company if he is the sole member of the board of directors and the sole shareholder.

In a company with two or more members of the board of directors, the accounts may be kept by a member of the board of directors by written agreement with the company. The person must have appropriate qualifications as an accountant, such as a certificate, diploma, experience or appropriate knowledge in the field of accounting.

Many companies outsource their bookkeeping, but this is an additional cost.

NILLTFN is the Law on the Prevention of Money Laundering and the Financing of Terrorism and Proliferation.

The law requires the subject to register with the Financial Intelligence Receiving and Analysis System and to develop an internal control and sanctions monitoring system for AML/CFT.

Virtual currency exchange services

Outsourced accountants

Sale of precious metals, precious stones and articles thereof

Issue of guarantees and other instruments of obligation

Providers of services for the establishment and operation of a legal entity

Advising clients on financial matters

Lending, including financial leasing, where the provision of services is not subject to licensing

Independent legal service providers

Tax consultants

Persons providing collection services

Intermediaries in real estate transactions

Sale of vehicles

Labour law requires employers (if you have employees) to organise and operate an occupational health and safety system in your company.

If the company has fewer than 5 employees, the employer may not involve the competent authority and manage everything himself.

More information on the website of the National Labour Inspectorate.

The URonline team will prepare and submit all the necessary documents on your behalf

Only €25Before submitting your documents, it is imperative to check whether the name you have chosen is already registered or applied for. This can be done, for example, in the Lursoft database. If the name is taken, you will have to choose another name, as it must not overlap with an existing name. Note that punctuation, spaces and the use of lower or upper case letters are not considered to be sufficient distinction.

Yes, you can register an LLC without a physical office, but a registered office is a requirement. You can register a registered office in real estate owned by yourself, with the owner's permission in the property of friends or family members, or use a virtual office service. However, be careful with virtual addresses as they may have a low degree of reliability if a large number of companies are registered there.

After submitting all the necessary documents to the Register of Enterprises, the notary public examines them within one to three working days on average. The process may take longer if errors or omissions are found in the documents.

The most common problems that can cause the Register of Companies to delay or refuse registration are:

Incorrect application form (KR4).

One of the required documents is missing, such as the consent of a board member.

Documents are not signed with a secure electronic signature (eSignature) or not notarised (if sent by post).

No payment of the stamp duty or proof of payment.

The legal address does not have an accurate cadastral designation or there is doubt about the legal basis for its use.

Although not required by law, the use of a lawyer or other specialist is recommended. Specific knowledge is needed to prepare and submit documents accurately. Errors in the documents may cause delays in the registration process or even refusal by the Register of Enterprises.

Yes, a foreigner can be a member of the board of directors of an LLC. If the person does not have a personal identification number of the Republic of Latvia, an additional questionnaire for inclusion in the Register of Natural Persons must be submitted. It is important to ensure that the board member is not prohibited by law from holding this position.

he main difference is the size of the share capital. The share capital of a full-capital limited liability company must be at least €2,800, while that of a small-capital limited liability company can be, for example, €1. A general partnership has several advantages, such as greater credibility in the business environment, the possibility to pay extraordinary dividends and the possibility for one person to own several such companies.

It depends on the situation. If a company has only one shareholder, who is also the sole member of the board, and a monthly turnover of less than five minimum salaries (€3,700 in 2025), he may not receive a salary and may pay out the profits in dividends. In this case, the tax burden is lower (only 20% UIT) compared to payroll taxes. However, it should be borne in mind that no social contributions are payable in the absence of a salary.

Registration in the VAT register of the State Revenue Service (SRS) is compulsory if:

The total value of VAT-able transactions (supplies of goods and services) in the last 12 months exceeds €50 000.

The value of goods purchased in the European Union exceeds €10 000 in a calendar year.

If the share capital is paid up in cash and the amount does not exceed EUR 50 000, a separate certificate from the bank or payment institution need not be submitted to the Register of Companies. The founders must certify in the application form KR4 that a temporary account has been opened in the name of the company to be incorporated and that the share capital has been paid into it.

No, it is not compulsory to set up a Supervisory Board. The Supervisory Board is a supervisory body that monitors the activities of the Management Board and its creation is a free choice of the founders themselves, which is laid down in the company's Articles of Association.

Mistakes often occur when the type of company is incorrectly reflected in various documents or when the cadastral designation of the registered office is incorrect.

The Register of Companies may refuse registration if the documents submitted do not comply with the requirements of the regulatory enactments or if the information contained therein is unclear. Often not all the required sections are filled in or there are inconsistencies between different documents (e.g. the memorandum and articles of association).

The name of the company must be unique - it must not be the same as a name already registered or applied for registration. The name must also not be misleading or contrary to good morals. Often founders do not check the availability of a name or try to register a name that is very similar to an existing one.

Registration requires a registered office. Problems arise if the address does not correspond to the National Address Register or if the property owner's consent has not been obtained. If the property has several owners, the consent of all is required. Sometimes an address is given where it is not actually possible to receive correspondence, which can cause problems with public authorities in the future.

For the establishment of a full-fledged LLC (with share capital above EUR 2,800), you need to open a temporary bank account and make a share capital contribution before submitting the documents to the Register of Companies. Errors occur when the contribution is not made in full or by someone other than the founder.

The law requires disclosure of information about the beneficial owners of the company - natural persons who directly or indirectly control the company. Failure to provide this information or providing false information is grounds for refusal of registration.

The articles of association must contain certain details, such as the company's name, the amount of share capital and the number of board members. No details of the founders or registered office may be given, as this information may change and is recorded in other documents.

Make sure the documents are in the correct format.

Documents must be signed with a secure electronic signature and time stamp.

Before submitting the documents, you must make sure that the amount of the stamp duty is correct and that you have paid it. Any incorrect or overpaid amount can be recovered by applying to the Companies Registry.

If the UR finds an error, the notary public postpones the decision for up to 30 days, pointing out the deficiencies. It is important to react promptly to such decisions and make the necessary corrections so that the registration process is not delayed and stamp duty is not lost.

A person who has been disqualified from exercising commercial activity by a court judgment or who is included in the SRS list of persons at risk cannot be appointed as a member of the Management Board. Similarly, a member of the Supervisory Board of the same company may not be a member of the Management Board.

If there are several members on the board, it is necessary to determine precisely their rights of representation - whether each can act alone or only together. A situation should not arise where one member has only a formal right of representation.

Website of the Register of Companies (UR): [https://www.ur.gov.lv/]

State Revenue Service (SRS) website: [https://www.vid.gov.lv/]

Commercial Law: [https://likumi.lv/]

This article will give you all the information you need about the process of setting up and registering a society, the documents required and the costs.

Company Liquidation (SIA) 2025: Step-by-Step Guide Liquidating a company, especially a SIA in Latvia, can seem complicated and even stressful